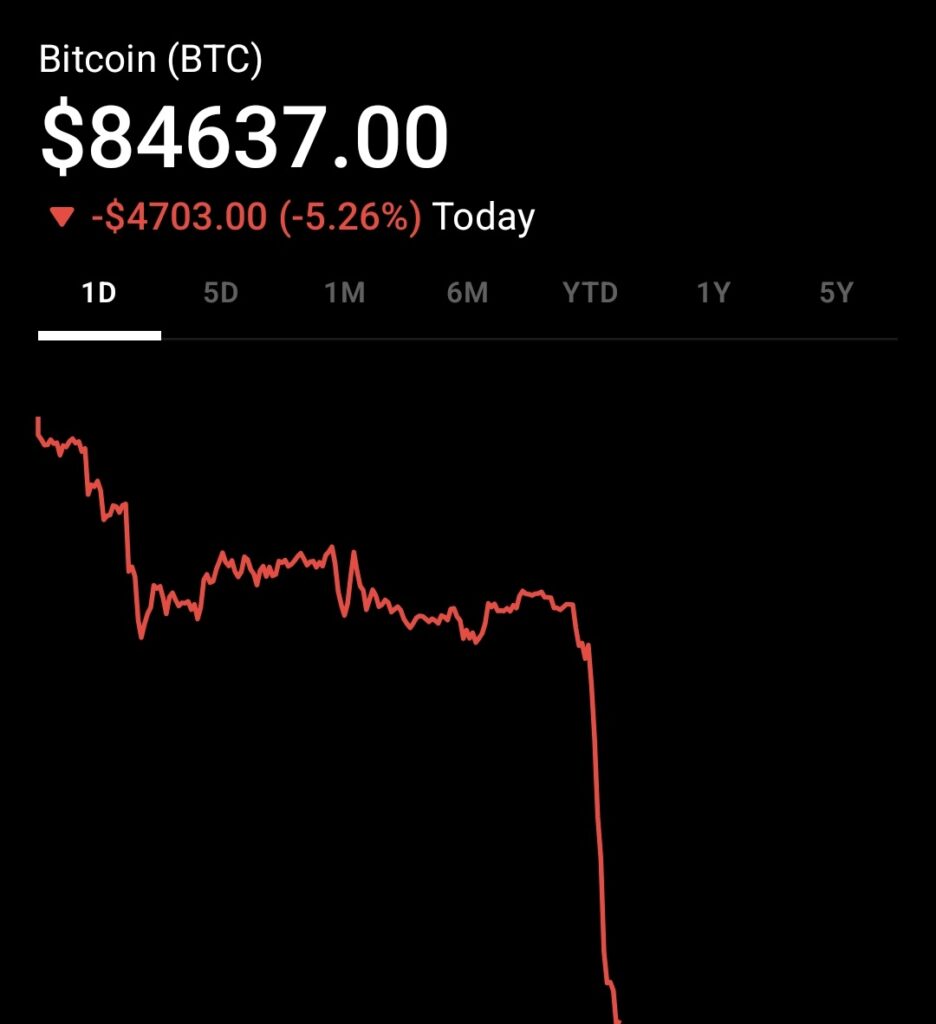

Cryptocurrency prices are broadly lower today, with major tokens sliding in value and overall market capitalization contracting. The total crypto market has fallen noticeably across leading coins, reflecting declining investor risk appetite. This shift in market behavior is driven by a mix of macroeconomic signals, technical selling pressure, and capital rotation into safer asset classes.

Market Performance Snapshot

Bitcoin and Ethereum

Bitcoin is trading below recent resistance levels while Ethereum has dipped under key price points, signaling short-term selling pressure in the market. These moves weigh on market confidence and often lead other digital assets to follow the same trend.

Broader Crypto Indicators

The aggregate market capitalization of cryptocurrencies has contracted, with total sector value retreating as risk assets struggle. Most large-cap tokens, including XRP and Solana are trading in negative territory, indicating widespread bearish sentiment.

Federal Reserve Policy and Market Impact

Interest Rate Outlook

Financial markets reacted to the central bank’s decision to maintain interest rates at current levels. The lack of an expected reduction in rates contributed to reduced appetite for high-volatility assets like cryptocurrencies, as investors favor yield-bearing instruments instead.

Sentiment Dynamics

With rates unchanged, some investors interpret the policy as a signal that economic strength remains intact. This can boost capital flows into bonds and other traditional assets, leaving less liquidity to support speculative markets such as crypto.

Safe-Haven Rotation and Risk Aversion

Shift to Traditional Assets

Prices of traditional safe-haven assets have strengthened, drawing money away from crypto. This rotation toward gold and commodities reduces demand for digital assets and increases downward pressure on prices.

Market Sentiment Measures

Market sentiment indicators are showing increased caution, with risk aversion rising among traders and fund managers. When confidence weakens, crypto markets are often among the first to reflect that shift.

Technical and Trading Factors

Resistance and Support Levels

Major cryptocurrencies have encountered technical resistance near key price zones, and the failure to break above these levels has contributed to short-term bearish momentum. Automated trading systems frequently amplify these moves.

Liquidations and Position Unwinding

Heightened volatility has led to a rise in forced liquidations of leveraged positions. This process adds selling pressure in the market and can accelerate declines in token prices, especially during sudden sentiment changes.

Broader Economic and Geopolitical Considerations

Global Risk Environment

Geopolitical risks and uncertainty in international markets tend to reduce investor willingness to hold high-volatility assets. Crypto markets, given their speculative nature, are particularly sensitive to shifts in global risk perception.

Cross-Market Correlations

Cryptocurrencies often move in tandem with broader risk assets such as equities. When traditional markets weaken or volatility spikes, crypto tends to follow these trends due to increased correlation with mainstream financial instruments.

What This Means for Market Participants

Today’s crypto downturn reflects a convergence of macroeconomic signals, risk-off sentiment, and technical dynamics rather than a single isolated event. Traders and investors should view these movements as part of the market’s broader response to financial conditions and policy signals influencing risk asset pricing.