Banking

Banking is the system and set of services that help you store, use, move, and grow your money safely. It serves as the home base for your financial life, giving you a reliable place where income arrives, bills are paid, and savings are protected.

At its core, banking connects you to the modern money system. Without it, managing everyday financial tasks would be slow, risky, and inefficient.

Posts on Banking

What Banking Does for You

Banking is not a single product. It is a collection of services that work together to make money usable in daily life. Each function plays a specific role in keeping your finances stable and organized.

Keeps Your Money Safe

Instead of keeping cash at home where it can be lost or stolen, banks hold your money securely. In most countries, deposits are insured by the government, which means even if a bank fails, your money is protected up to a certain limit.

This safety net allows people to store large amounts of money without worrying about physical risks or fraud.

Lets You Spend and Receive Money

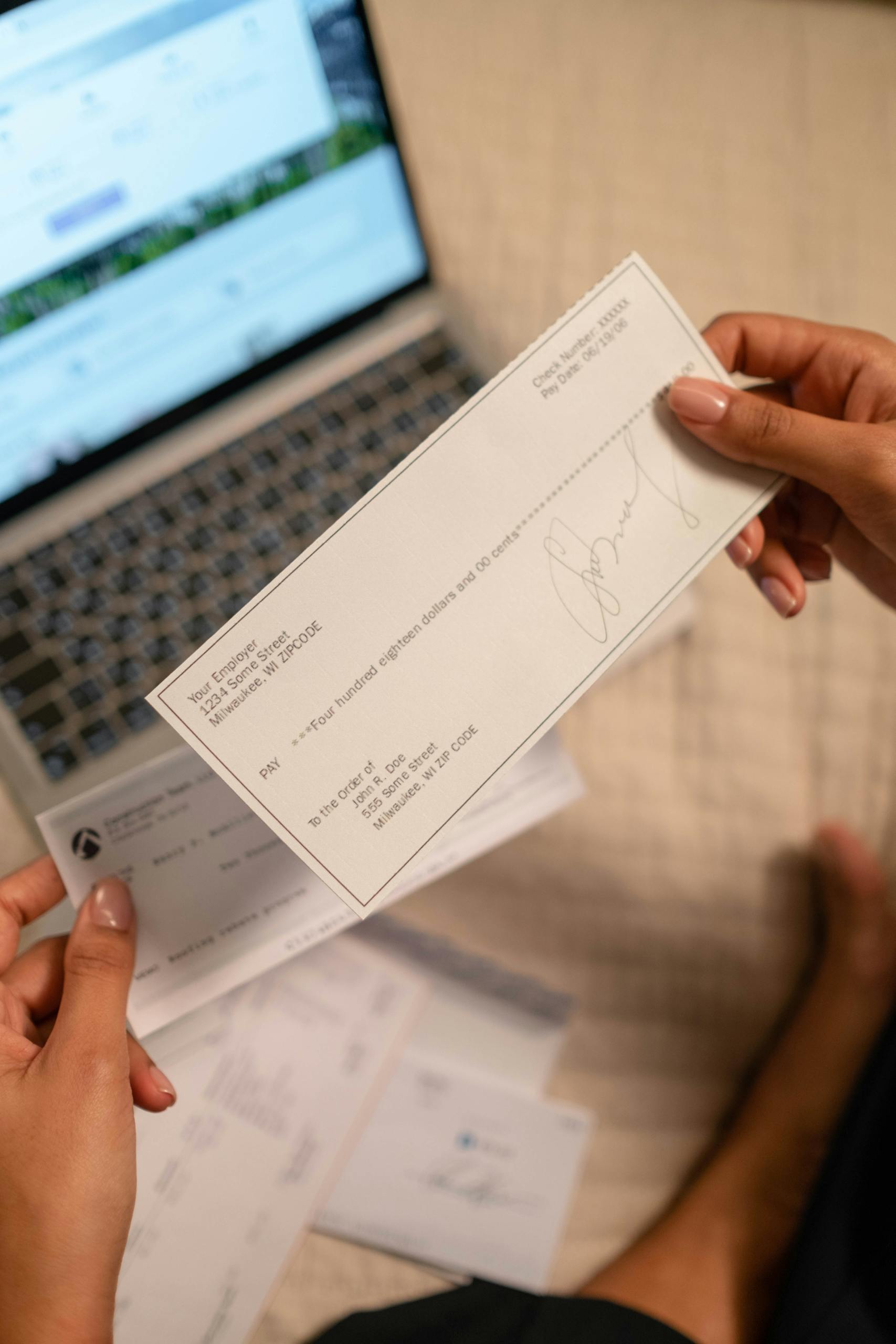

Banks make it possible to move money quickly and reliably. Through different tools, you can get paid, make purchases, and send funds to others without using cash.

Common ways banks let you move money include:

- Checking accounts

- Debit cards

- Online payments

- Direct deposit

- Zelle, Venmo, and bank transfers

These systems allow you to receive income, pay bills, buy goods and services, and send money to friends, family, or businesses.

Helps You Save

Banks also help you separate spending money from savings. This makes it easier to avoid using money you plan to keep for the future.

Common savings options include:

- Savings accounts

- High yield savings accounts

- Money market accounts

These accounts store your money safely while paying interest. Over time, that interest allows your balance to grow, even if slowly.

Lets You Borrow Money

Borrowing is a key function of banking. Banks lend money to individuals so they can make large purchases or cover expenses when they do not have enough cash on hand.

Banks provide:

- Credit cards

- Personal loans

- Car loans

- Mortgages

- Student loans

These tools allow you to buy now and pay later. They also help you build a credit history, which affects your ability to borrow in the future.

Creates a Financial Record

Every transaction that passes through your bank creates a record. This information is stored in your statements and account history.

Bank records show:

- Income

- Spending

- Savings

- Debt

These records are used for taxes, budgeting, loan applications, renting apartments, and long term financial planning. Without banking records, proving your financial stability would be difficult.

The Two Main Bank Accounts

Most people use two primary types of bank accounts. Each has a different purpose and together they form the foundation of personal money management.

- Checking account for everyday spending such as bills, groceries, and rent

- Savings account for money you do not plan to spend soon

Using both allows you to keep daily spending separate from long term goals, which improves financial control.

Conclusion

Banking is the system that manages your money, where it is stored, how it moves, how it grows, and how you borrow. It provides the structure that makes modern financial life possible.

Without banking, earning income, paying bills, saving for the future, or getting a loan would be far more difficult.