Personal Finance

What is Personal Finance?

Personal finance is the discipline of managing money in a way that supports both present stability and long term goals. It combines practical decision making with strategic planning to create financial security.

At its core, personal finance is about controlling how money is earned, spent, protected, and grown. When these elements are aligned, individuals gain clarity, confidence, and resilience.

TOP PICKS

Budgeting

Budgeting is the foundation of all financial control. It ensures that every unit of income has a defined purpose, whether for spending, saving, or investing.

A well structured budget prevents waste and exposes habits that weaken financial health. Consistent budgeting turns income into a reliable tool rather than a source of stress.

Popular Posts on Budgeting

Saving

Saving is the act of preserving money for future use. It creates a financial buffer that protects against uncertainty and supports planned goals.

Regular saving builds discipline and financial independence. Even small, consistent contributions can grow into meaningful security over time.

Popular Posts on Saving

Banking

Banking provides the infrastructure for managing and storing money safely. It allows individuals to receive income, pay expenses, and access financial services efficiently.

Using the right banking tools improves cash flow management and reduces unnecessary fees. A strong banking setup is essential for daily financial operations.

Popular Posts on Banking

Debt Management

Debt management focuses on controlling and reducing borrowed money. Not all debt is harmful, but unmanaged debt weakens financial stability.

A clear repayment strategy lowers interest costs and frees future income. Responsible debt use supports growth while avoiding long term financial strain.

Popular Posts on Debt Management

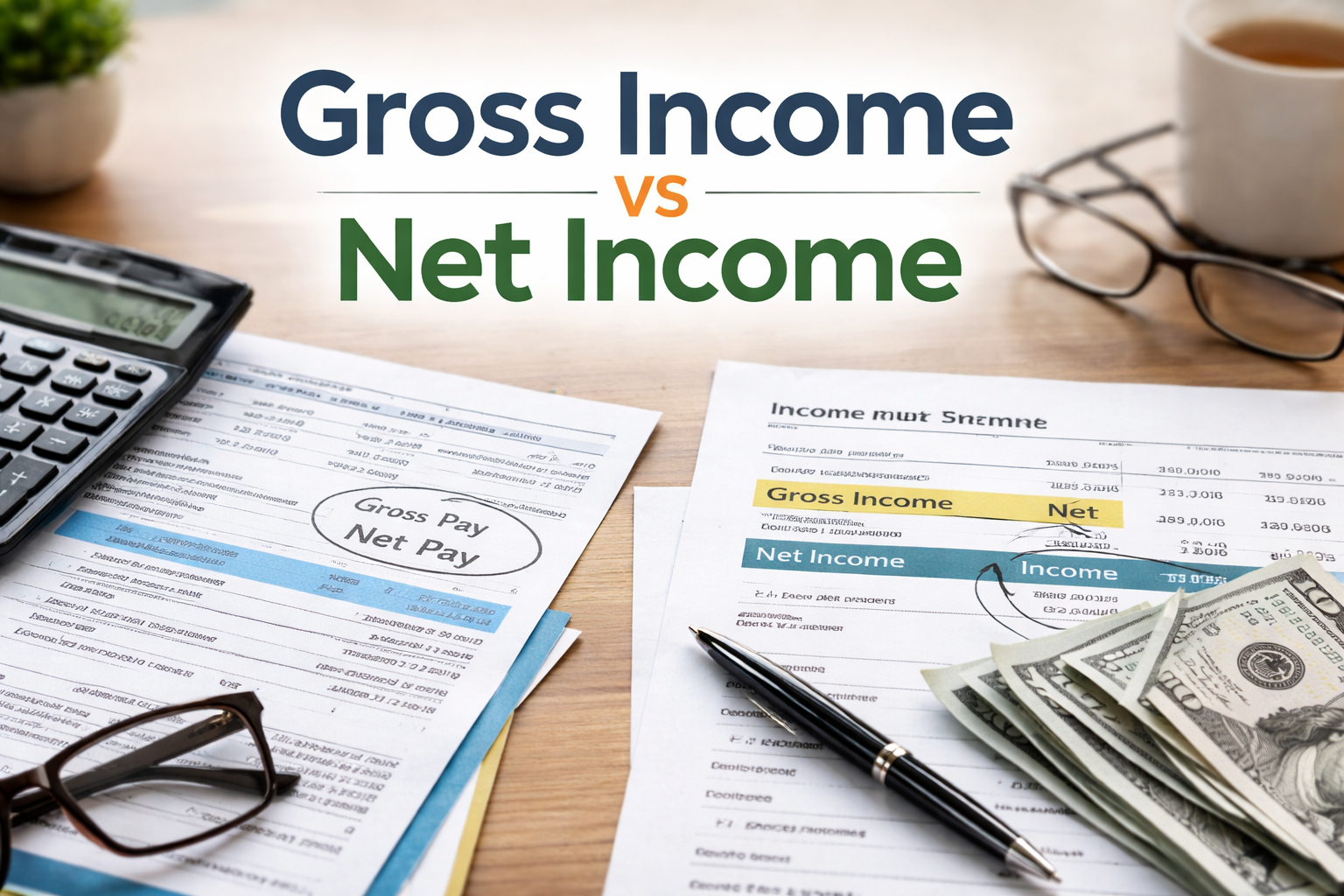

Income

Income is the starting point of every financial plan. It includes wages, business earnings, and any other cash inflows.

Increasing and stabilizing income expands financial options. Strong income management ensures that effort translates into lasting financial progress.

Popular Posts on Income

Investing

Investing is the process of putting money into assets that are expected to grow in value. It allows wealth to compound over time.

Strategic investing builds long term financial strength. It transforms savings into engines of future income and security.

Popular Posts on Investing

Insurance and Risk Management

Insurance protects against financial losses caused by unexpected events. It shifts risk away from the individual to a broader system.

Proper coverage preserves wealth and prevents setbacks from becoming disasters. Risk management is essential for long term financial stability.

Popular Posts on Insurance and Risk Management

Retirement and Pensions

Retirement planning ensures that income continues when active work ends. It requires early and consistent preparation.

Pensions and retirement accounts provide structure for this goal. A disciplined approach guarantees financial independence in later life.

Popular Posts on Retirement

Taxes

Taxes are a mandatory part of financial life. They affect income, investments, and spending.

Effective tax planning improves overall financial efficiency. Understanding tax obligations prevents penalties and preserves more of what is earned.

Popular Posts on Taxes

Behavioral Finance

Behavioral finance examines how emotions and habits influence money decisions. It explains why people often act against their own financial interests.

By mastering behavior, individuals make more rational choices. Strong financial outcomes depend as much on mindset as on math.

Popular Posts on Behavioral Finance

Summary

Personal finance is not a single action but a system of connected decisions. Each category supports the others in building stability and growth.

When managed with discipline and knowledge, personal finance becomes a powerful tool. It enables control, confidence, and long term financial success.