Financial Markets

Financial markets are the backbone of modern economies. They provide structured platforms where individuals, institutions, and governments can exchange financial assets in an organized and regulated environment. Through these markets, capital flows from those who have surplus funds to those who need financing for productive activities. This continuous movement of money supports economic growth, innovation, and stability.

At a fundamental level, financial markets enable price discovery. Prices of assets such as stocks, bonds, and currencies reflect collective expectations about future performance, risk, and economic conditions. By aggregating information from millions of participants, markets offer signals that guide investment and policy decisions.

Posts on Financial Markets

What Are Financial Markets?

Financial markets are systems or networks that facilitate the buying and selling of financial instruments. These instruments represent claims on future cash flows, ownership rights, or contractual obligations. Markets can be physical, such as traditional trading floors, or electronic, where transactions occur through digital platforms.

The defining feature of financial markets is their ability to connect savers and borrowers efficiently. Savers earn returns on their capital, while borrowers gain access to funds required for expansion, consumption, or public spending. This intermediation function is critical for efficient resource allocation in an economy.

Key Characteristics of Financial Markets

Financial markets share several core characteristics that define how they function and why they matter.

- Liquidity, which allows assets to be bought and sold quickly with minimal price impact

- Transparency, which ensures that prices and trading information are widely available

- Regulation, which promotes fairness, reduces fraud, and protects participants

- Competition, which enhances efficiency and narrows transaction costs

Each of these characteristics contributes to market confidence and long-term sustainability.

Types of Financial Markets

Financial markets are diverse, reflecting the wide range of financial instruments and economic needs they serve. Understanding the major categories helps clarify how capital flows through the global financial system.

Capital Markets

Capital markets deal with long-term financing instruments. They are essential for funding business expansion, infrastructure projects, and government development programs.

Capital markets are generally divided into equity markets and debt markets. Equity markets allow companies to raise capital by selling ownership stakes to investors. Debt markets enable governments and corporations to borrow money by issuing bonds that promise regular interest payments and repayment of principal.

Money Markets

Money markets focus on short-term borrowing and lending, typically involving instruments with maturities of one year or less. These markets are crucial for managing liquidity within the financial system.

Participants in money markets include banks, corporations, and governments that need to manage short-term cash requirements. By providing a venue for low-risk, short-duration instruments, money markets contribute to overall financial stability.

Foreign Exchange Markets

Foreign exchange markets facilitate the exchange of one currency for another. They are the largest and most liquid financial markets in the world, supporting international trade, investment, and tourism.

Currency prices fluctuate based on interest rates, economic performance, geopolitical developments, and market sentiment. These movements influence export competitiveness, inflation, and cross-border investment returns.

Derivatives Markets

Derivatives markets trade contracts whose value is derived from underlying assets such as stocks, bonds, commodities, or interest rates. Common derivatives include futures, options, and swaps.

These markets serve important risk management functions. Businesses and investors use derivatives to hedge against price fluctuations, interest rate changes, or currency movements. At the same time, derivatives markets also attract participants seeking to profit from price volatility.

Commodity Markets

Commodity markets enable the trading of physical goods such as metals, energy products, and agricultural items. These markets play a vital role in price discovery and supply chain planning.

Producers use commodity markets to lock in prices and manage revenue risk, while consumers and manufacturers gain insight into future input costs. Commodity prices often reflect broader economic trends and geopolitical conditions.

Primary and Secondary Markets

Financial markets are further classified based on whether securities are being issued for the first time or traded among investors.

Primary Markets

Primary markets are where new securities are created and sold to investors. Companies and governments raise fresh capital by issuing stocks or bonds directly to buyers.

The funds raised in primary markets go to the issuer, supporting investment, expansion, or public spending. This process is essential for capital formation and economic development.

Secondary Markets

Secondary markets facilitate the trading of existing securities among investors. In these markets, the issuer does not receive funds from transactions.

Secondary markets provide liquidity and enable investors to adjust their portfolios over time. Active secondary markets increase the attractiveness of primary market offerings by assuring investors they can exit positions when needed.

Role of Financial Market Participants

A wide range of participants interact within financial markets, each serving distinct functions that contribute to overall efficiency.

Individual Investors

Individual investors participate in financial markets to build wealth, generate income, and achieve long-term financial goals. Their decisions are influenced by risk tolerance, time horizon, and financial literacy.

Although individual transactions may be small, collectively these investors have a significant impact on market dynamics and liquidity.

Institutional Investors

Institutional investors manage large pools of capital on behalf of others. Their scale allows them to influence asset prices and corporate governance practices.

These investors often adopt sophisticated strategies, including diversification, hedging, and active management, shaping market trends and standards.

Financial Intermediaries

Financial intermediaries such as banks, brokerages, and asset managers connect buyers and sellers. They reduce transaction costs, provide expertise, and manage risk.

By facilitating trades and offering advisory services, intermediaries enhance market accessibility and efficiency.

Regulators and Policymakers

Regulators oversee financial markets to ensure fairness, stability, and transparency. Policymakers use market signals to inform monetary and fiscal decisions.

Effective regulation balances innovation with risk control, helping prevent systemic crises while allowing markets to evolve.

Importance of Financial Markets in the Economy

Financial markets play a central role in economic development and stability. Their impact extends beyond investors and institutions to households and governments.

Efficient financial markets promote savings and investment, enabling economies to grow and adapt. They also support entrepreneurship by providing access to capital for new ventures and expanding firms.

Markets contribute to risk sharing by allowing participants to diversify exposures. This reduces the economic impact of shocks on individual entities and supports resilience at the system level.

Risks and Challenges in Financial Markets

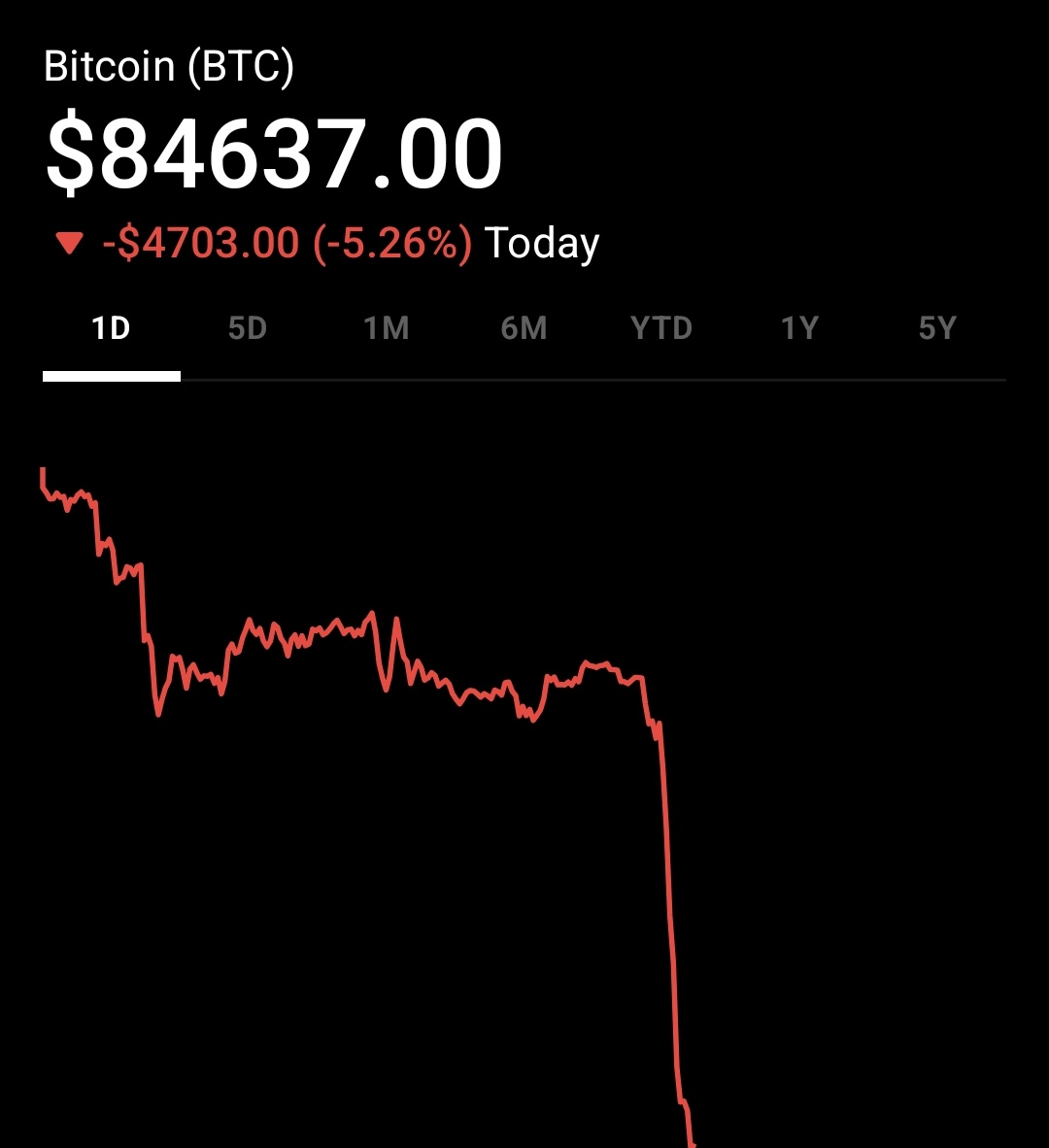

Despite their benefits, financial markets are not without risks. Volatility, speculative behavior, and information asymmetry can lead to mispricing and instability.

Systemic risk arises when interconnected institutions and markets amplify shocks, potentially triggering widespread disruptions. Historical financial crises highlight the importance of prudent regulation, sound risk management, and market discipline.

Technological advancements also introduce new challenges, including cybersecurity threats and rapid transmission of market stress through automated trading systems.

The Future of Financial Markets

Financial markets continue to evolve in response to technological innovation, globalization, and changing investor preferences. Digital platforms, data analytics, and automation are transforming how assets are traded and managed.

Sustainability considerations are increasingly shaping investment decisions, with greater attention to environmental, social, and governance factors. These trends are redefining capital allocation and corporate behavior.

As financial markets adapt, their core purpose remains unchanged. They exist to connect capital with opportunity, manage risk, and support economic progress.

Conclusion

Financial markets are foundational to the functioning of modern economies. They facilitate capital formation, enable efficient pricing, and provide mechanisms for risk management. By bringing together diverse participants and instruments, markets channel resources to their most productive uses.

For investors, policymakers, and businesses alike, understanding financial markets is essential. A well-functioning market system supports growth, stability, and innovation, reinforcing its role as a cornerstone of global economic activity.