Budget planner templates are practical tools that convert financial goals into measurable actions. They give structure to income, expenses, and savings so decisions are made based on data rather than guesswork. A well designed template helps households control cash flow, reduce waste, and consistently move toward long term financial stability.

Below are four essential budget planner templates used in personal finance management. Each one serves a different planning purpose and together they create a complete money management system.

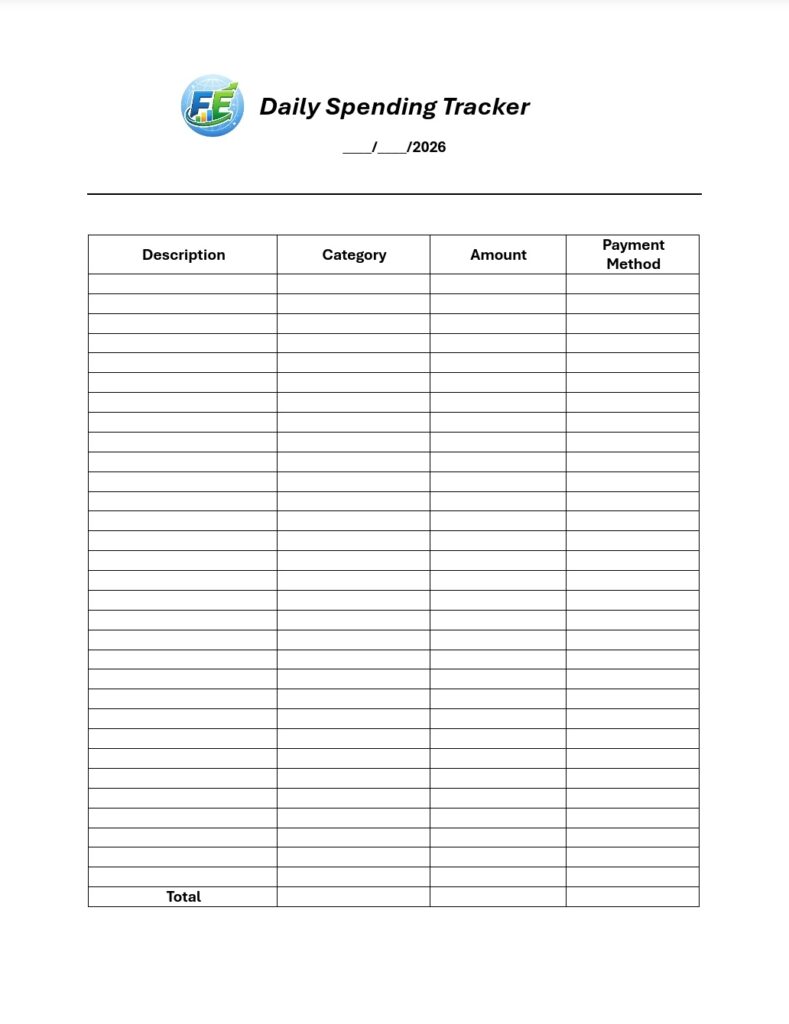

Daily Budget Planner

A daily budget planner tracks every dollar you spend throughout the day. It helps prevent impulse purchases and makes you more aware of small expenses that usually go unnoticed.

This template works best when used alongside weekly or monthly budgets.

For each expense, you record the amount and a short note. At the end of the day, you compare total spending with your daily limit to see whether you stayed on track.

Daily tracking builds strong money discipline because you correct mistakes immediately instead of waiting until the end of the month.

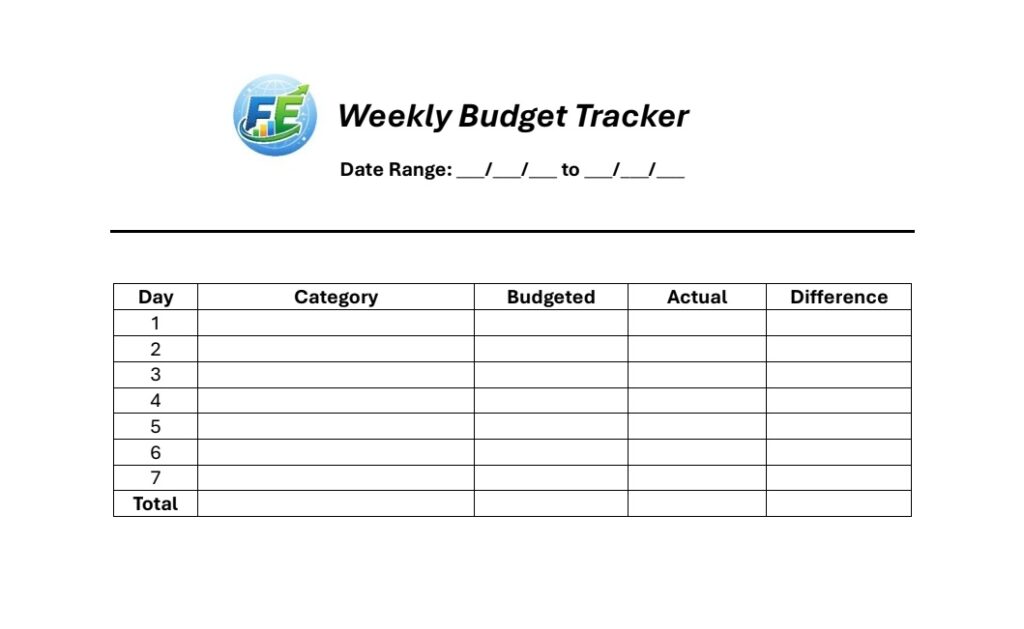

Weekly Budget Tracker

Weekly budgeting breaks the month into smaller and more manageable segments. It is especially effective for people who tend to overspend early in the month and struggle later.

This template creates discipline by giving you daily spending limits and immediate feedback on your behavior.

For each day, you record planned spend, actual spend, and notes. This provides a real time view of financial habits.

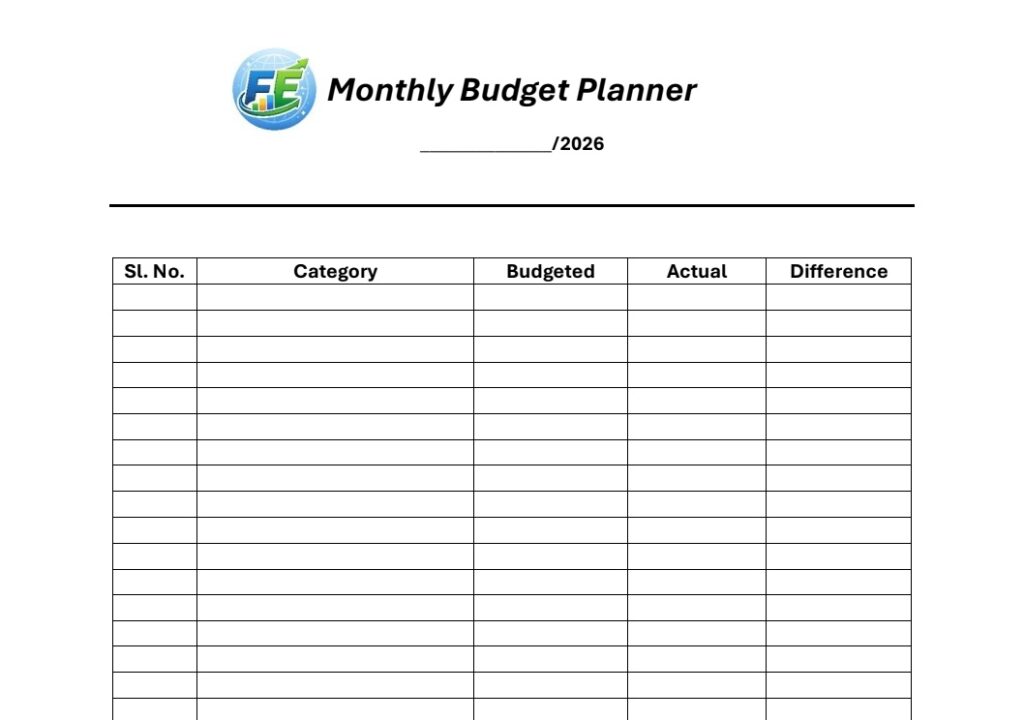

Monthly Budget Planner

The monthly budget planner is the foundation of any budgeting system. It allows you to compare what you planned to spend with what you actually spent, making it easy to identify overspending and underfunded categories.

This template is ideal for managing regular household finances and keeping all major spending categories visible in one place.

Monthly Budget Structure

Income and expenses are listed in a clear table that tracks three figures: budgeted amount, actual amount, and the difference.

Using this structure ensures every dollar is tracked and no major cost is overlooked.

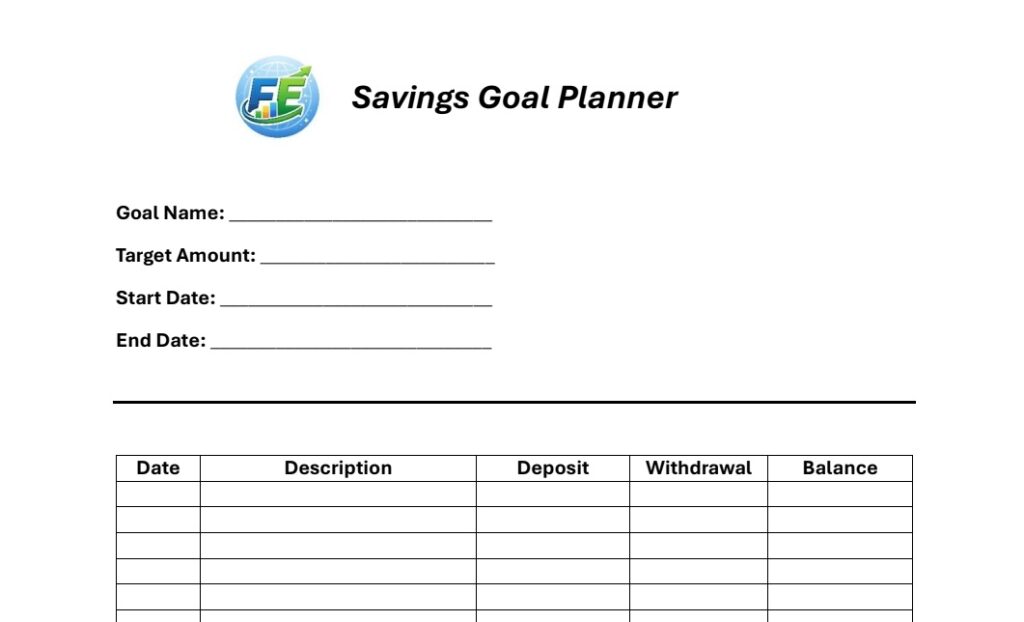

Savings Goal Planner

Saving is more effective when it is tied to clear goals. A savings goal planner gives structure to those goals and tracks your progress over time.

This template is useful for both short term and long term financial targets.

Examples include an emergency fund, a vacation, or a major purchase such as a laptop.

Why Budget Planner Templates Matter

Budget planner replace vague financial intentions with measurable results. They help individuals stay accountable, plan for the future, and respond quickly to financial challenges. When used together, they form a complete financial control system that supports both daily spending and long term wealth building.